What Is The

EB-5 Visa Program

The EB-5 Immigrant Investor Program was created in 1990 by the U.S. Congress. It is targeted towards foreign nationals qualified to obtain permanent residency by investing in the U.S. economy and as a result creating at least 10 full-time jobs for Americans. Currently, this program is administered by USCIS which have set the minimum required investment amount to $1.05 million or $800,000 if the investment project occurs in a Targeted Employment Area, which is either a rural or high unemployment area.

On March 15, 2022, President Biden signed the EB-5 Reform and Integrity Act as part of the Consolidated Appropriations Act, 2022 (Public Law 117-103), which created new requirements for the EB-5 immigrant visa category and the Regional Center Program. Immigrant visas are authorized under the Regional Center Program through Sept. 30, 2027.

All EB-5 investors must invest in a new commercial enterprise, which is a commercial enterprise:

- Established after Nov. 29, 1990, or

- Established on or before Nov. 29, 1990, that is:

- Purchased and the existing business is restructured or reorganized in such a way that a new commercial enterprise results, or

- Expanded through the investment so that a 40-percent increase in the net worth or number of employees occurs

Commercial enterprise means any for-profit activity formed for the ongoing conduct of lawful business including, but not limited to:

- A sole proprietorship

- Partnership (whether limited or general)

- Holding company

- Joint venture

- Corporation

- Business trust or other entity, which may be publicly or privately owned

This definition includes a commercial enterprise consisting of a holding company and its wholly owned subsidiaries, provided that each such subsidiary is engaged in a for-profit activity formed for the ongoing conduct of a lawful business. Note: This definition does not include noncommercial activity such as owning and operating a personal residence.

Recent Changes To The EB-5 Visa

The EB-5 Reform and Integrity Act of 2022

The recently passed EB-5 Reform and Integrity Act of 2022 allows previously approved regional centers to develop investment projects more quickly and new investors to submit immigration applications with less of a waiting time. The U.S. government is now required to set aside 32% of the total annual visa quota for certain types of EB-5 investment projects, of which:

- 20% are reserved for rural areas projects;

- 10% are reserved for High Unemployment Area projects

- 2% reserved for infrastructure projects

What Does This Mean?

This means, at a minimum, that USCIS reserves nearly a third of all total EB-5 visas for rural projects, high unemployment area projects, and infrastructure projects. Furthermore, USCIS will roll-over any of these reserved visas that are unused in the fiscal year to the next fiscal year. If the reserved visa quota for the second year is still not used up, the unused quota will be released for use by all EB-5 applicants. USCIS will give priority to investment immigration applications for projects in rural areas. Judging from the newly released Fiscal Year 2023 immigrant schedule, whether it is Form A or Form B, EB-5 rural areas, areas with high unemployment rates and infrastructure projects have no waiting time for applicants from mainland China. Other types of EB-5 projects will still have a long waiting time for applicants from mainland China.

In addition, according to the new EB-5 Act, EB-5 applicants in the United States can submit I-526 immigrant applications and I-485 status adjustment applications at the same time on the premise that there is no project schedule; The I-526 application is still pending, but if it meets the above conditions, it can also submit the I-485 application before the I-526 application is approved. The I-485 application allows the applicant to apply for a work visa and a return permit while waiting for the approval result, which means that after graduation, or a B-type tourist visa holder expires, as an EB-5 Applicant, with no schedule of the project, you can still legally reside, study and work in the United States until the I-485 approval is completed.

What Is Required For The EB-5 Visa?

Capital Investment

The minimum qualifying investment in the United States is $1,050,000 (a $50,000 dollar increase from before 03/15/2022) OR $800,000 for a Targeted Employment Area and infrastructure projects (a $300,000 increase from before 03/15/2022.) This cash amount must have been achieved through lawful means which can be proven by the following:

- Bank Statements

- Investment Statements

- Profits or proceeds from sale of real estate

- Profits and earnings from a business

- Profits and earnings from stock or other investments

- Documents showing ownership of real estate or business

- Loan, mortgage, promissory note, security agreement, or other evidence of borrowing

- Tax returns

- Proof of being an “accredited investor”

The investment does not have to necessarily be made in cash. Cash equivalents, such as certificates of deposits, securitized loans, and promissory notes can all be counted in the total. You can also count in the value of any equipment, inventory, or other tangible property you put into the business. You must make an equity investment (ownership share) and you must place your investment at risk of partial or total loss if the business closes.

Capital means cash and all real, personal, or mixed tangible assets owned and controlled by the immigrant investor. All capital will be valued at fair-market value in U.S. dollars. The definition of capital does not include:

- Assets acquired, directly or indirectly, by unlawful means (such as criminal activities);

- Capital invested in exchange for a note, bond, convertible debt, obligation, or any other debt arrangement between the immigrant investor and the new commercial enterprise;

- Capital invested with a guaranteed rate of return on the amount invested; or

- Capital invested that is subject to any agreement between the immigrant investor and the new commercial enterprise that provides the immigrant investor with a contractual right to repayment, except that the new commercial enterprise may have a buy back option that may be exercised solely at the discretion of the new commercial enterprise.

Note: Investment capital cannot be borrowed.

Targeted Employment Area (TEA)

A targeted employment area is an area that, at the time of investment, is a rural area or an area experiencing unemployment of at least 150 percent of the national average rate.

A rural area is any area outside a metropolitan statistical area (as designated by the Office of Management and Budget) or outside the boundary of any city or town having a population of 20,000 or more according to the decennial census.

Job Creation

An EB-5 investor must invest the required amount of capital in a new commercial enterprise that will create full-time positions for at least 10 qualifying employees.

For a new commercial enterprise not located within a regional center, the new commercial enterprise must directly create the full-time positions to be counted. This means that the new commercial enterprise (or its wholly owned subsidiaries) must itself be the employer of the qualifying employees.

For a new commercial enterprise located within a regional center, the new commercial enterprise can directly or indirectly create the full-time positions. Up to 90% of the job creation requirement for regional center investors may be met using indirect jobs

- Direct jobs establish an employer-employee relationship between the new commercial enterprise and the person it employs.

- Indirect jobs are held outside of the new commercial enterprise but are created as a result of the new commercial enterprise.

In the case of a troubled business, the EB-5 investor may rely on job maintenance.

- The investor must show that the number of existing employees is, or will be, no less than the pre-investment level for a period of at least two years.

Note: Investors may only be credited with preserving jobs in a troubled business. A troubled business is an enterprise that has been in existence for at least two years and has incurred a net loss during the 12- or 24-month period prior to the priority date on the immigrant investor’s Form I-526. The loss for this period must be at least 20 percent of the troubled business’ net worth prior to the loss. For purposes of determining whether the troubled business has been in existence for two years, successors in interest to the troubled business will be deemed to have been in existence for the same period of time as the business they succeeded.

A qualified employee is a U.S. citizen, permanent resident or other immigrant authorized to work in the United States. The individual may be a conditional resident, an asylee, a refugee, or a person residing in the United States under suspension of deportation. This definition does not include the immigrant investor; his or her spouse, sons, or daughters; or any foreign national in any nonimmigrant status (such as an H-1B visa holder) or who is not authorized to work in the United States.

Full-time employment means employment of a qualifying employee by the new commercial enterprise in a position that requires a minimum of 35 working hours per week. In the case of the Immigrant Investor Pilot Program, “full-time employment” also means employment of a qualifying employee in a position that has been created indirectly from investments associated with the Pilot Program.

A job-sharing arrangement whereby two or more qualifying employees share a full-time position will count as full-time employment provided the hourly requirement per week is met. This definition does not include combinations of part-time positions or full-time equivalents even if, when combined, the positions meet the hourly requirement per week. The position must be permanent, full-time and constant. The two qualified employees sharing the job must be permanent and share the associated benefits normally related to any permanent, full-time position, including payment of both workman’s compensation and unemployment premiums for the position by the employer.

Why Choose Us?

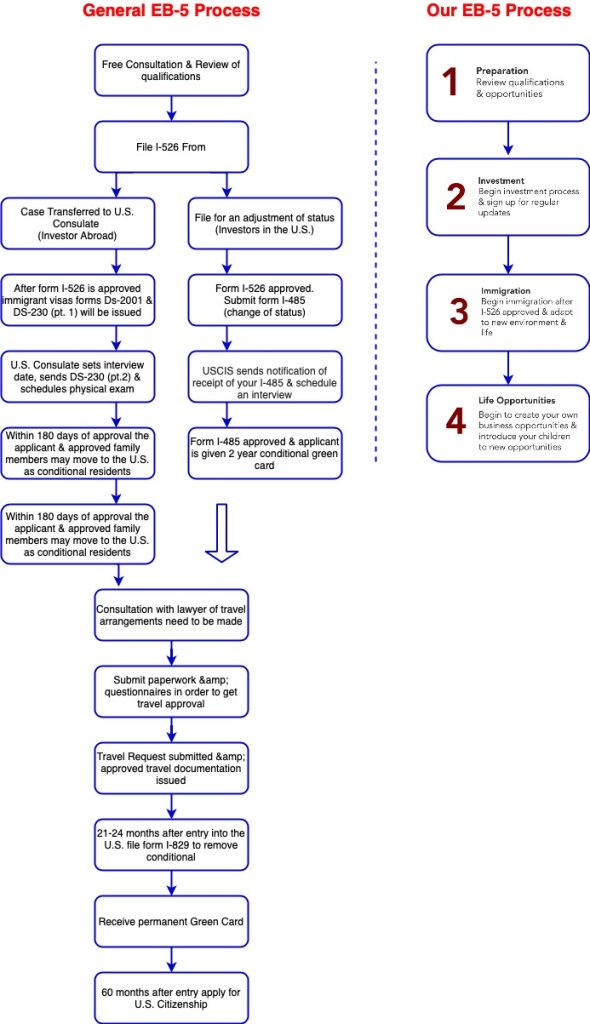

Applying for the EB-5 Visa tends to be a really complicated and time consuming process. Here at American National Regional Center, we have developed our own simple yet efficient rendition of such process. You can see how our process compares to other regional centers below: